carried interest tax proposal

Carried interest income flowing to the general partner of a private investment fund often is treated as capital gains for the purposes of taxation. Carried interest is very generally a share of the profits in a partnership paid to its manager.

How Congress Can Stop Corporations From Using Stock Options To Dodge Taxes Itep

It no longer is based on the underlying holding period of the asset but rather the holding period in the applicable partnership interest API.

. Last month the House Ways and Means Committee marked up the Build Back Better Act to include a provision modifying how carried interest is treated under the tax code. However carried interest attributable to a real property trade or business would retain a three-year holding period requirement. A new proposal to tax carried interest as ordinary income was just attached to a larger tax and spending bill that could be voted on by the House as early as tomorrow.

Although the bill did not advance in Congress at the time Senator Wyden who is now chair of the Senate Finance Committee may renew his plan to end this tax break. Second it proposes to treat all income in respect of a carried interest defined as an investment services partnership interest as ordinary income subject to self-employment taxes if the partners taxable income from all sources exceeds 400000. House Ways and Means Committee Chairman Richard Neal on Monday proposed a major set of tax hikes to fund Democratic President Joe Bidens social spending plans one tax break popular among major Democratic Party donors was left in placethe taxation of carried interest income at the lower capital gains rate.

14 Sep 2021 0. The proposed Ending the Carried Interest Loophole Act S. The proposal which is part of a 35 trillion tax and spending package that House leaders say could get a vote by Oct.

Federal income tax treatment of partnership interests issued in exchange for services commonly known as carried interests. The typical carried interest amount is 20 for private equity and hedge funds. The Biden administrations proposal to tax carried interest at a higher rate like the ill-fated proposal from the Trump administration.

Some view this tax preference as an unfair market-distorting loophole. 1 lengthens the time period investment funds must hold assets to five years. Carried interest offers lower tax rate than for income Biden administration had proposed eliminating the tax break House Democrats.

Lobbyists shielded carried interest from Bidens tax hikes top White House economist says Published Thu Sep 30 2021 1243 PM EDT Updated Thu Sep 30 2021 202 PM EDT Christina Wilkie. Marylands House and Senate proposed legislation to apply a 17 percent additional state income tax to carried interest and management fees. Maryland proposes tax on carry management fees.

Carried Interest Tax Proposal Threatens Charitable Giving. Carried Interest Raises 141 billion. Notable examples of private equity funds that charge.

The Biden administration fact sheet misleadingly implies that a carried interest tax would only hit hedge funds while other proponents of the tax hike portray carried interest as a perk for private equity. Democratic Senator Ron Wyden proposed legislation in 2019 that would have taxed all carried interests irrespective of holding period as compensation income subject to self-employment tax. The New York proposal from Governor Andrew Cuomos D budget would tax carried interest at a 17 percent rate to offset the difference between the federal top marginal income tax rate of 37 percent and the capital gains tax rate of 20 percent.

1639 would treat the grant of carried interest to a general partner as a loan from the limited partners made at a preferred interest rate. Would if enacted tax all or some of carried interest as ordinary income or treat the granting of carried interest as a subsidized loan. The proposal would generally extend the three-year holding period required for carried interest to be taxed as a capital gain as opposed to ordinary income to five years.

The second proposal is similar to the previously failed legislation repeatedly introduced in the House by Rep. But in reality the tax as proposed in the administrations plan would impact partnerships of all sizes including those with individual partners earning less than the. If the fund manager receives a 20 carried interest in exchange for managing investors capital of 100 million and the prescribed interest rate for the tax.

On August 5 2021 Senate Finance Committee Chairman Ron Wyden and Senator Sheldon Whitehouse introduced proposed legislation the Ending the Carried Interest Loophole Act or the Proposal that would substantially change the US. The lawmakers provided this example. Unlike previous proposals in other states even funds located outside the state would be hit by the tax if they invest in Maryland businesses.

Others argue that it is consistent with the tax treatment of other entrepreneurial income. Benefits of the Carried Interest Legislative proposals to reduce or eliminate the tax benefits of the Carried Interest have failed on several occasions in the last 10 years including in 2017 3 year holding period rather than 1 year to obtain long-term capital gain treatment Holding period applies to sale of Carried Interest. The first of these changes is the whole approach to determining what is subject to Section 1061.

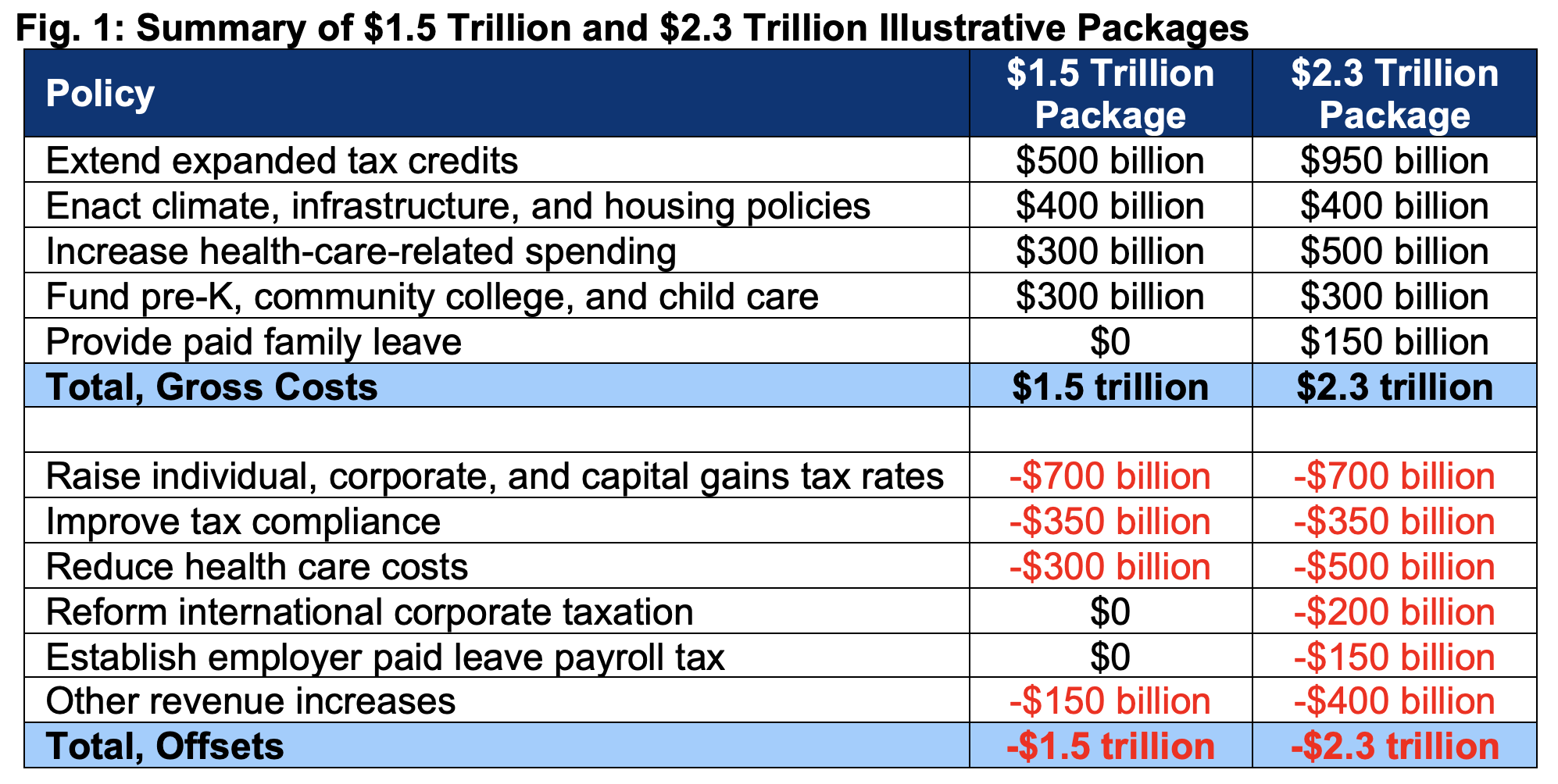

Build Back Better For Less Two Illustrative Packages Committee For A Responsible Federal Budget

How Should Progressivity Be Measured Tax Policy Center

Get Your Business Gst Ready With Easy Online Accounting Software Accounting Accounting Services

Moving Toward More Equitable State Tax Systems Itep

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

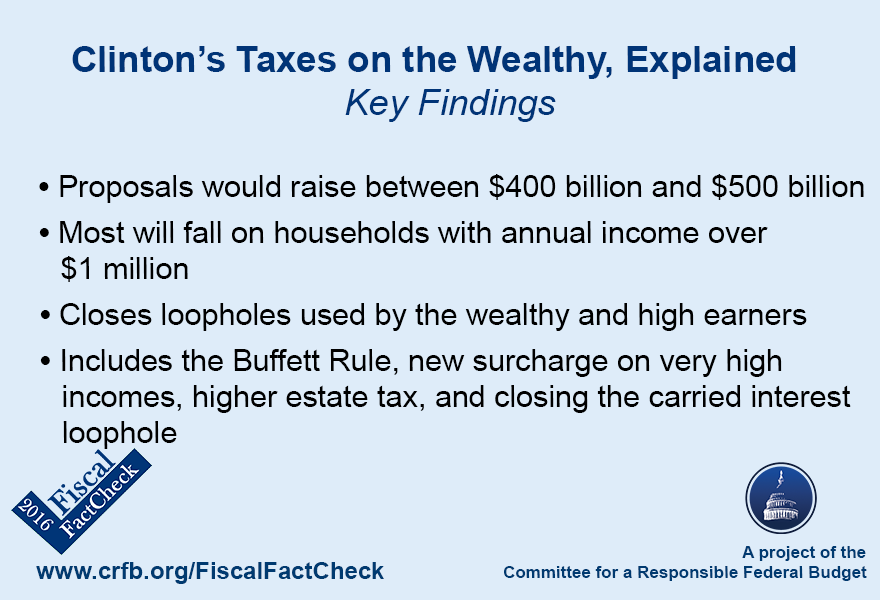

Clinton S Taxes On The Wealthy Explained Committee For A Responsible Federal Budget

Tax Proposals Under The Build Back Better Act Version 2 0

House Capital Gains Tax Better For The Super Rich Than Biden Plan

Collaboration Tools Which Boost Stakeholder Engagement Engagement Strategies Business Management Degree Business Management

How Should Progressivity Be Measured Tax Policy Center

Build Back Better Requires Highest Income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

What Are The Consequences Of The New Us International Tax System Tax Policy Center

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Income Tax Increases In The President S American Families Plan Itep

What Are The Consequences Of The New Us International Tax System Tax Policy Center

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)